SUPER MATCHING – SUPER STORM COMING

The ATO is readying to collect on $4 billion in underpaid or late superannuation. A renewed government focus plus Federal Budget funding will enable account matching technology to compare STP reported super with that supplied to the ATO by super funds at scale. The foundations have been set to reverse a decade long ATO tradition of wrist slapping for superannuation errors and a reactive approach to SG compliance.

The ATO new tech initiative announcement follows a raft of others last year, showing them cracking down on small business debt. Within the same context of post-pandemic enthusiasm to recoup tax, it is predicted the ATO is equally reading themselves to collect for employees on the estimated near $4 billion in under paid superannuation.

The Member Account Transaction Service has superannuation houses providing details of superannuation payments to the ATO. For those businesses who are found to have not paid, paid incorrectly, or paid late, heavy penalties could be applied. STP reporting provides the ATO with a clear line of sight to the super that should have been paid.

What the ATO did identify was that through the use of STP data matching with Member Account Transaction Service data they will move from a reactive approach to a proactive approach in undertaking ATO Initiated audits rather than relying on employees to “dob in” the employer when failing to pay SG.

What does this mean for you?

The single biggest impact this data matching process will have on your business is having to deal with the Super Guarantee Charge if you are found to have done the wrong thing and not met your obligations on time and in full.

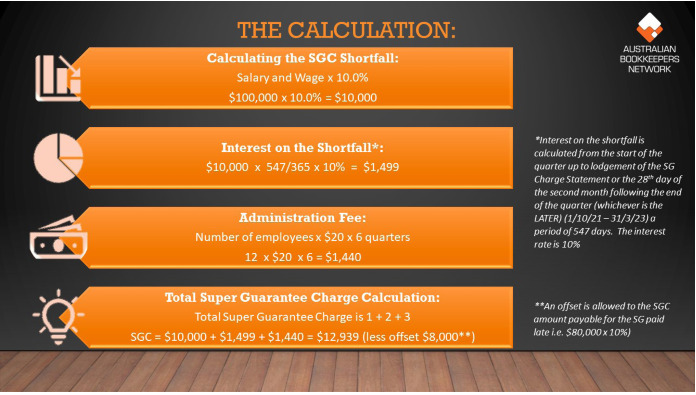

The Super Guarantee Charge (SGC) is a punitive measure that impacts the employer in the following ways:

- the super (10.5%) & penalties are not tax deductible;

- the employer must pay notional interest (in place of earnings that would have accrued had the Super Guarantee (SG) contribution been made on time) and an administration fee ($20 per employee, per quarter);

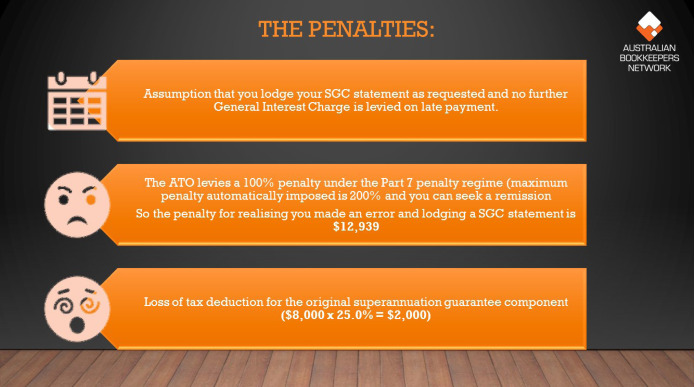

- there are further penalties for late payment and failure to lodge a SGC statement;

- the shortfall in super contributions is based on ‘salary & wages’ which is potentially higher than Ordinary Times Earnings (OTE); and

- the employer will have to put time into preparing the SGC statement.

Does paid mean paid?

The simple answer is no! As an employer you could be caught out even though you paid the SG before the lodgement due date. The popular accepted perception of due dates for payments for SG is the 28th day following the end of each calendar quarter. The reality is that the legislation makes it clear that SG is not deemed paid until it is received by the trustee of the employee’s super fund. This means that the employer has to allow enough time for a payment to clear their bank account, pass from the clearing house they use and into the trustee’s hands for the employee’s super fund. How long can that take? A few days up to a couple of weeks is the reality. This leaves employers in an invidious position of being accountable for delays in processing of SG contributions, even though it is totally outside their control. There is one exception to this and this is only where an employer uses the ATO Sponsored Small Business Superannuation Guarantee Clearing House. In this case, and only in this case, the superannuation is deemed paid when it is received by the Clearing House.

The best way of understanding the impact to your business where there has been a failure to meet SG contributions is by taking a look at the following example.

Example: Super Guarantee (Late Payments)

Joe’s cafe pay their Super Guarantee for the December 2021 quarter 1 month late. They were advised by their bookkeeper that they now have an obligation to lodge a Super Guarantee Charge Statement and pay SGC. Joe Ignored that advice as in his mind the employee’s had received their Superannuation and what did it matter if it was only 1 month late.

Fast forward to February 2023 and the ATO undertakes a data matching exercise and detect the late payment and require lodgment of an SGC Statement. Joe has no choice and completes the SGC statement on 31st of March. Total wages for the quarter in question was $100,000 and includes overtime for some of the 12 employees. Ordinary Time Earnings for the same period was $80,000 which was the amount the SG late payment was based on.

Conclusion

Had Joe paid the superannuation on time (which in this example was 1 month earlier) the total after tax cost of the superannuation for the quarter was $6,000. After estimated penalties at 100% (it could be more or less than this) the total cost of the Super Guarantee Charge to Joe is $25,878 – almost $20,000 more than had he made the original payment on time.

The takeaway is that the ATO is getting serious about employers who either don’t pay their superannuation guarantee commitments or pay them late. If your business falls into either of these categories, it is only a matter of time until you attract the attention of the ATO. Make no mistake, this will be very costly for a business who has failed in this area. It is a great time to talk to your bookkeeper to plan how you can ensure you never fall into such a category.

Please contact us if you have any questions or require our assistance.