Federal Budget 2022: What it Means for You, Your Family & Your Business

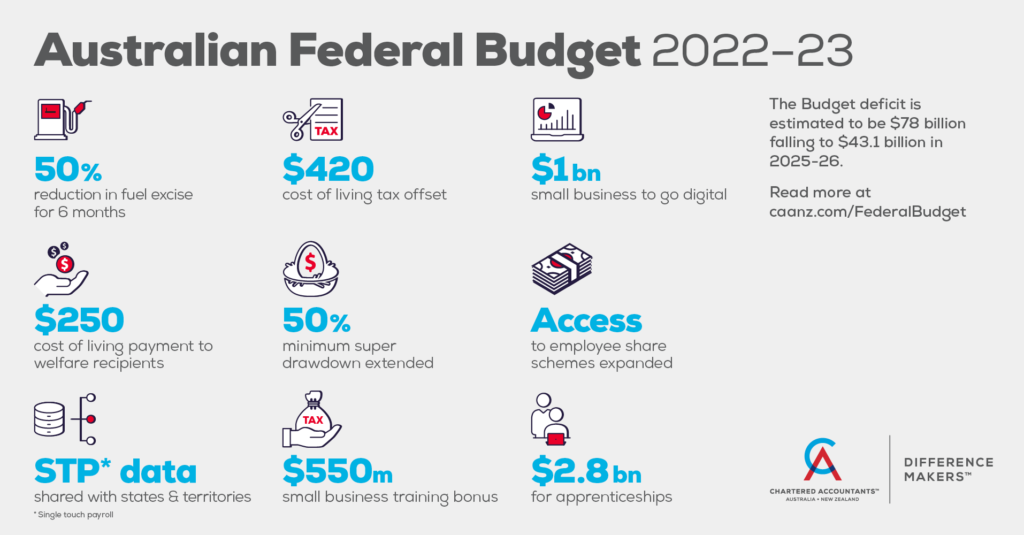

The Federal Budget was released on Tuesday 29 March 2022, significantly earlier than usual. There is no doubt this is a pre-election budget with a real focus on cost of living and trying to win over voters.

We have highlighted those points that we believe are most relevant to our clients and partners, broken down into the following sections:

- Individuals

- SMEs/Business

- Superannuation

- Tax Administration

- 5 Key Takeaways

Should you want a more in depth read, the ABC has a good overall summary of the Budget “Winners and Losers”.

We emphasise that some of these measures are, at this stage, proposals, and will require legislation to be passed through both houses of Parliament to gain Royal Assent.

With the budget announcement we will shortly be finalising and introducing our 2022 tax planning packages to our clients, to help them minimise their tax obligations. If you think this would help you and your business, please contact us to book in a session with one of our consultants.

INDIVIDUALS

- Low and middle income tax offset to be increased by $420

The low and middle income tax offset (LMITO) will include a cost of living tax offset in the 2021–22 income year. The cost of living tax offset is a flat $420 to be applied to all recipients of LMITO when they lodge their tax return. The LMITO is a non-refundable tax offset.

- One-off payment to ease cost of living pressures

Individuals who are currently in receipt of an Australian government allowance or pension will receive a one-off payment of $250 in April 2022 to ease the cost of living pressures. Certain concession card holders will also get the payment. The cost of living payment will be exempt from tax and will not count towards an individual’s income for social security income test purposes.

- Work-related COVID-19 tests tax deductible from 1 July 2021

Costs of taking a COVID-19 test to attend a place of work will be tax deductible for individuals and exempt from fringe benefits tax from 1 July 2021.

- Paid Parental Leave scheme enhancements

The Paid Parental Leave scheme will be overhauled by combining the current Parental Leave Payment (18 weeks paid leave for the primary carer) and the Dad and Partner leave payment (2 weeks paid leave) into a single combined Paid Parental Leave pay scheme of up to 20 weeks.

Leave will be fully flexible and both parents will be able to choose how they split the leave periods between themselves. The Paid Parental Leave can be taken any time within 2 years of the birth or adoption of their child.

- Temporary reduction in fuel excise

To help reduce the cost of living, from 12:01 am on 30 March 2022, the excise and excise-equivalent customs duty on petrol and diesel will be reduced by 50%. The reduction in fuel excise will be in place for 6 months, ending at 11:59pm on 28 September 2022.

The 50% reduction will reduce the excise from 44.2 cents per litre to 22.1 cents per litre, and applies to petrol, diesel and all other fuel and petroleum-based products except for aviation fuels.

SMEs/BUSINESS

- More COVID-19 business grants will be tax exempt

Payments from additional state and territory COVID-19 business support grant programs will be made non-assessable non-exempt income (NANE) for income tax purposes until 30 June 2022. The NANE treatment is to support businesses affected by state or territory lockdowns during the pandemic.

- Increased deduction for small business external training expenditure

Small and medium businesses will be able to deduct an additional 20% of expenditure incurred on external training courses provided to their employees.

The additional deduction will apply for businesses with aggregated turnover of less than $50 million. The external training course must be delivered by an Australian entity and provided to employees in Australia or online. In-house or on-the-job training and expenditure for persons other than employees will be excluded.

The measure will apply for eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 (Budget night) until 30 June 2024. Where eligible expenditure is incurred before 1 July 2022, the additional deduction will be claimed in the tax return for the following income year.

- Increased deductions for digital adoption by small businesses

Small and medium businesses will be able to deduct an additional 20% of eligible expenditure supporting digital adoption.

The additional deduction will apply for businesses with aggregated turnover of less than $50 million. Eligible expenditure will include the cost of depreciating assets and business expenses supporting digital adoption, such as portable payment devices, cyber security systems or subscriptions to cloud-based services. An annual cap of $100,000 will apply to expenditure eligible for the additional deduction.

The measure will apply for eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 (Budget night) until 30 June 2023. Where eligible expenditure is incurred before 1 July 2022, the additional deduction will be claimed in the tax return for the following income year.

- Apprenticeship wage subsidy extended

The Boosting Apprenticeship Commencements wage subsidy will be extended to support businesses and Group Training Organisations that take on new apprentices and trainees. The subsidy will now be available to 30 June 2022. This measure will provide for an additional 35,000 apprentices and trainees. Eligible businesses will be reimbursed up to 50% of an apprentice or trainee’s wages of up to $7,000 per quarter for 12 months.

- Expanded access to unlisted company employee share schemes

For employers that make larger offers in connection with employee share schemes in unlisted companies, participants can invest up to:

> $30,000 per participant per year, accruable for unexercised options for up to 5 years, plus 70% of dividends and cash bonuses, or

> any amount, if it would allow them to immediately take advantage of a planned sale or listing of the company to sell their purchased interests at a profit.

Regulatory requirements for offers to independent contractors will be removed, where they do not have to pay for interests.

- PAYG income tax instalment system set for structural overhaul

The gross domestic product (GDP) uplift rate that applies to pay-as-you-go (PAYG) instalments and GST instalments will be set at 2% for the 2022–23 income year (previously 10%).

The 2% uplift rate will apply to instalments for the 2022–23 income year that fall due after amending legislation receives assent.

SUPERANNUATION

- Extension of the reduction in superannuation minimum drawdown rates

The halving of the superannuation minimum drawdown requirements for account-based pensions and similar products will be extended for a further year to 30 June 2023.

The minimum drawdown requirements determine the minimum amount of a pension that a retiree must drawdown from their superannuation in order to qualify for tax concessions.

- Removal of the $450 per month income threshold

Announced last year, from 1 July 2022, the $450 per month income threshold under which employers do not need to make superannuation guarantee contributions for employees will be removed (legislation was passed on 28 February 2022).

Employers will therefore be required to make superannuation guarantee contributions on behalf of all employees, irrespective of their level of remuneration.

- Work Test reforms

From 1 July 2022, the Work Test will be removed for individuals aged 67 to 75 years in relation to non-concessional and salary sacrificed superannuation contributions. The Work Test will still apply for personal deductible (concessional) contributions.

Until 30 June 2022, an individual who is 67 to 74 years of age can only make voluntary superannuation contributions if they have has been gainfully employed for at least 40 hours over a 30-day period in the applicable financial year (known as the “Work Test”).

- First Home Super Saver Scheme

From 1 July 2022, the maximum amount of voluntary contributions that can be released under the First Home Super Saver Scheme (“FHSSS”) will increase from $30,000 to $50,000.

The FHSSS was first introduced from 1 July 2017 to provide individuals with the ability to save money for their first home using the benefit of concessionally taxed superannuation.

TAX ADMINISTRATION

- PAYG instalment systems to be modernised

Companies will be able to choose to have their PAYG instalments calculated based on current financial performance, extracted from business accounting software, with some tax adjustments.

The government will consult with affected stakeholders, tax practitioners and digital service providers to finalise the policy scope, design and specifications of this measure.

Subject to advice from software providers about their capacity to deliver, it is anticipated that systems will be in place by 31 December 2023, with the measure to commence on 1 January 2024, for application to periods starting on or after that date.

- Reporting of taxable payments reporting system data

Businesses will be allowed the option to report taxable payments reporting system data (via accounting software) on the same lodgment cycle as their activity statements.

Subject to advice from software providers about their capacity to deliver, it is anticipated that systems will be in place by 31 December 2023, with the measure to commence on 1 January 2024, for application to periods starting on or after that date.

Consultation with affected stakeholders, tax practitioners and digital service providers will take place to finalise the policy scope, design and specifications of the measure.

- Digitalising trust and beneficiary income reporting and processing

Trust and beneficiary income reporting and processing will be digitalised, by allowing all trust tax return filers the option to lodge income tax returns electronically, increasing pre-filling and automating ATO assurance processes.

The measure is proposed to commence from 1 July 2024, subject to advice from software providers about their capacity to deliver.

- Enhanced sharing of STP data

IT infrastructure will be developed to allow the ATO to share single touch payroll (STP) data with state and territory revenue offices on an ongoing basis.

The government will commit $6.6 million for this measure. Funding has already been provided for by the government. The funding will be deployed following further consideration of which states and territories are able and willing to invest in their own systems and administrative processes to pre-fill payroll tax returns with STP data, to reduce compliance costs for businesses.

- ATO Tax Avoidance Taskforce to be extended

The ATO will be given funding to extend the operation of the Tax Avoidance Taskforce by 2 years to 30 June 2025.

The taskforce was established in 2016 to undertake compliance activities targeting multinationals, large public and private groups, trusts and high wealth individuals. The taskforce also scrutinises specialist tax advisors and intermediaries that promote tax avoidance schemes and strategies.

5 KEY TAKEAWAYS

1. Utilise incentives to upskill your workforce

Can you use the skills and training boost for financial support to upskill your workforce?

SME businesses will get an additional 20% deduction for the cost of external training courses provided to employees. There is no cap, but the course needs to be delivered by an Australian provider.

Look at your planned investment in your employees. Keep in mind that the additional deduction on any costs incurred in FY22 I cannot be claimed until FY23.

2. Invest in digitising your business

Look at your planned investment in technology and digitisation.

In addition to the existing temporary full expensing (“TFE”) measures set to end on 30 June 2023, a new measure will allow SME business a “boost”, that is an additional 20% deduction, for expenses on digital adoption (e.g. portable payment devices, cyber security systems or subscriptions to cloud-based services).

The boost will apply to eligible expenditure of up to $100,000 per year. Additional information is required but based on examples provided in the Budget overview, this will effectively cap the tax saving to $25,000 per year (at a 25% tax rate).

Keep in mind that the additional deduction on any costs incurred in FY22 cannot be claimed until FY23.

Also, remember that if you want to apply the TFE, the asset needs to be installed and ready for use by 30 June 2023, so watch out for those lead times on capital assets, and plan ahead.

3. Cash flows and cost savings

One of the key themes of the Budget related to the cost of living. Relevant to SMEs, the Government has announced that it will temporarily halve the excise rate on petrol and diesel for 6 months.

For SME businesses, the Budget included a measure to reduce the GDP uplift factor on PAYG income tax and GST instalments (from 10% to 2%) for the 2023 income year.

Businesses with less than $10 million annual aggregated turnover will be eligible for the lower GST instalment, and businesses with less than $50 million annual aggregated turnover will be eligible for the lower PAYG instalments.

4. Tax reporting continues to be digitised

Digitisation means more pre-filling, data-matching and data-sharing.

The measures are designed to reduce compliance costs for businesses, but also make it easier for the ATO and other revenue authorities to data-match and share information.

Some of these measures include:

> The option for businesses to report Taxable Payment Reporting data electronically, at the same time as BASs.

> Sharing Single Touch Payroll information with revenue offices to pre-fill payroll tax returns.

> Using real time accounting data to calculate PAYG tax instalments.

5. ATO Tax Avoidance Taskforce

The ATO has been given additional funding to target multinationals, large corporates, private groups and high wealth individuals.

This is expected to increase tax collections by $2.1 billion in a three year period. We can expect continued ATO review activity under programs such as the Top 500 Private Groups and the Next 5000 programs. Division 7A, trusts, capital gains and international dealings are some of the areas the ATO most commonly finds issues with.

GOT A QUESTION?

Please don’t hesitate to get in touch.